The fresh new Virtual assistant promises 25% of full loan amount. In cases like this, the loan number is actually $five-hundred,000. Hence, they are going to ensure $125,000 (five-hundred,000 x 0.25).

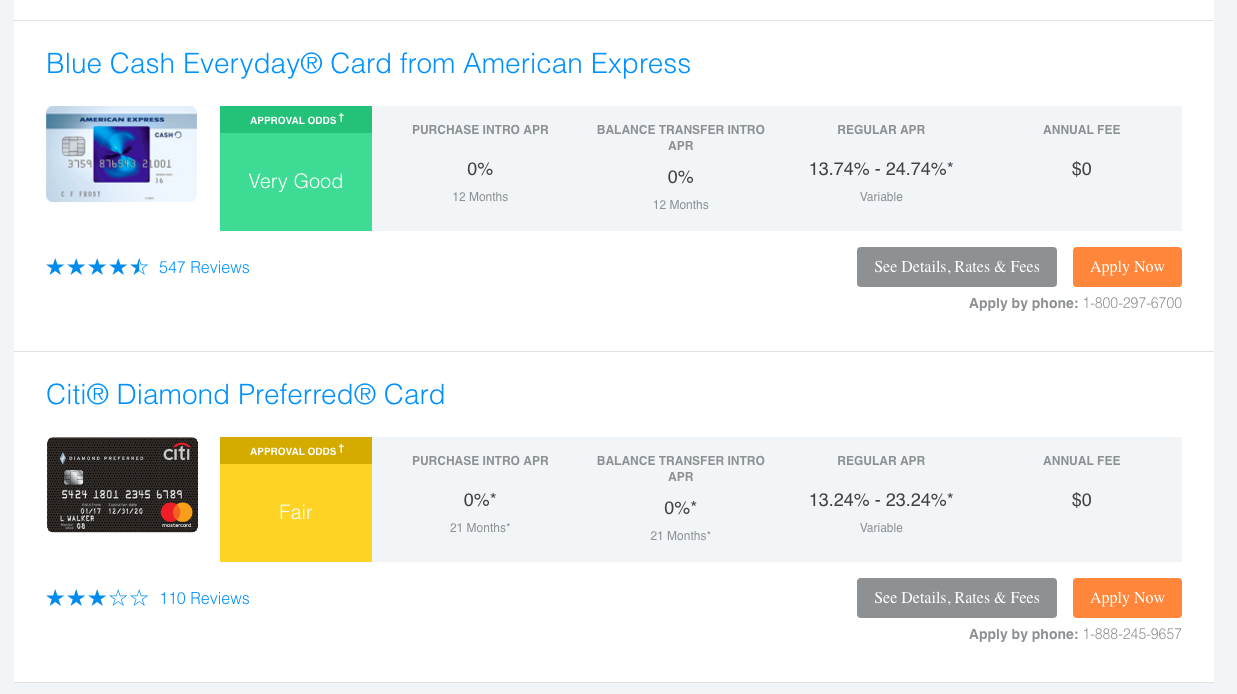

Now, we have a couple wide variety: their leftover entitlement of $101, due to the fact protected by the Virtual assistant and also the amount you’d need safety twenty five% of the loan. Since your remaining entitlement isn’t really equal to or more than just $125,000, you’ll have to afford the variation. Ergo, on this subject kind of $500,000 mortgage, you’ll want to create a deposit regarding $23,.

Obtain new Griffin Gold software today!

Need a beneficial COE are eligible for this new Va financing regarding a personal lender. Without it, you aren’t eligible as bank need certainly to guarantee your meet up with the VA’s solution conditions and have now sufficient remaining entitlement so you’re able to safer a great Virtual assistant financing which have zero % down.

Rather than which file, lenders can’t agree you getting a good Virtual assistant mortgage or the experts, therefore it is imperative to obtain their COE if you think you will be eligible to this work for. not, even when you’re unsure for individuals who qualify, you could request good COE about Va to know if your be eligible for a beneficial Virtual assistant financing before you apply with a lender.

Concurrently, your COE is essential having permitting loan providers know how much the fresh Va is actually ready to make certain if you standard on the financing. If you have already used your Virtual assistant loan, you might be necessary to make a deposit to pay for the newest twenty-five% make sure and you can consistently make use of about some of some great benefits of the borrowed funds.

This file and additionally identifies if you pay the new Va financing fee. Most borrowers would have to spend which fee, and that loans the program and assists other qualified consumers safe a Va mortgage.

How to get a certification regarding Qualification

Acquiring your own Virtual assistant mortgage Certification from Eligibility is extremely important for those who should pull out a great Va loan. Once you have acquired the COE, you could start looking a property and apply for a Virtual assistant loan. Definitely, it is essential to observe that their COE doesn’t verify financing approval. As an alternative, it simply informs loan providers your qualified to receive the newest Virtual assistant loan and exactly how the majority of your entitlement you have got remaining.

You can find an approach to get your COE, and some try faster than others. Including, for individuals who consult your COE actually to the Va, required doing six-weeks to get it of the mail. not, there are numerous other choices, which include next:

Consult your own financial

One of several most effective ways discover your own COE as approved to have a beneficial Va mortgage would be to ask your lender. VA-acknowledged loan providers can frequently accessibility an on-line program to quickly get your COE. Normally the most suitable choice if you have currently setup a deal for the property and would like to improve the applying processes.

Request COE on the internet

The brand new Va makes you demand their COE on line using the eBenefits portal . In the place of delivering a lender along with your Public Shelter amount and you will most other personal data, you can simply join otherwise manage a special account.

Get the COE because of the post

Another option is to print from Mode 26-1880 and you will mail they into the Va. Although not, for individuals who request the COE of the mail, it can take up to six-weeks otherwise extended, based on the reputation. For this reason, this is actually the the very least effective approach and probably a bad snap this site choice if you have currently set a deal inside the to the a home and want to move on having a sleek application procedure.

As an alternative, you could potentially prefer this package if you’re considering to invest in a home and wish to discover while qualified. On the other hand, you may need a new COE each time you make use of your Va financing, therefore if you’ve currently put the loan, you will want a different one before you apply for the next financing.